This mental model was designed to help investors make better investment decisions. However, you can also apply it to other areas of your life in order to be more efficient. You should always aim to operate within your Circle of Competence, because that is where your efforts will yield the highest reward.

Paolo Magaan

Growth & Value: Two Sides Of The Same Coin

What is better: growth investing or value investing? If you’re asking that question, you’re looking at things the wrong way.

The Education of a Value Investor by Guy Spier: Book Review

Guy Spier is refreshingly candid in The Education of a Value Investor. In finance, there’s a tendency for people to try and show off how intelligent they are. Yet Spier, who is clearly intelligent with a dual-degree from Harvard and Oxford (graduating at the top of his class for economics in the latter), goes out of his way to write instead about his insecurities, mistakes, and demoralizing setbacks on his journey to forge a career in finance and become more like his idol, Warren Buffett.

Netflix’s Tapeworm Business Model

A business without cash flow is useless to shareholders. In Netflix’s “Tapeworm” business model, everyone wins except shareholders, who will likely receive no cash despite paying a hefty premium for NFLX’s best-case scenario growth.

The Difference Between Speculating, Trading, and Investing

Throughout the site, you will notice that I often differentiate between speculating, trading, and investing. In this article, I shall explain the nuances that differentiate the three from each other.

Downsides of Investing In Micro Cap Stocks

The disadvantages and potential pitfalls of investing in stocks with market valuations under $300 million.

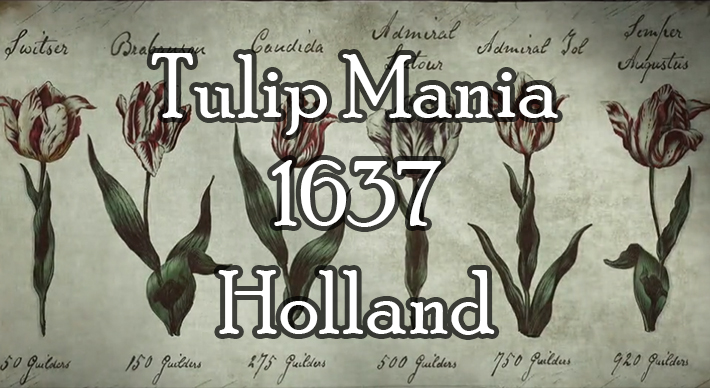

Tulip Mania, 17th century Holland – The First Financial Bubble in History

Tulip Mania was the first economic bubble recorded in history. It took place in Holland from 1633 to 1637 during the Dutch Golden Age in 1600 to 1720 when Holland boasted the highest per capita income in the world.

The South Sea Bubble – 1720 – Great Britain

This is the bubble that birthed the word “bubble.” It led to 5 banks shutting down, riots in London, aristocrats losing entire fortunes, and suicides.

Mississippi Bubble – 1720 – France

Ever wonder when the word “millionaire” was invented? The word “millionaire” was coined in France during the Mississippi Bubble in 1719, when ordinary people were getting rich from buying stock in the Mississippi Company.

How Value Investors Combat FOMO Trading

FOMO stands for “Fear of Missing Out.” When you chase an expensive stock and buy it simply because it keeps going up–despite having determined that the stock is too expensive or not within your circle of competence–that’s called FOMO Trading.