Ever wonder when the word “millionaire” was invented? The word “millionaire” was coined in France during the Mississippi Bubble in 1719, when ordinary people were getting rich from buying stock in the Mississippi Company.

The Mississippi Bubble was similar to the South Sea Bubble in that it was caused by a monopolistic company created through government charters; whose public share offerings led to a speculative frenzy, which subsequently collapsed when corruption came to light. It is one of the earliest economic bubbles in history (the first being Tulip Mania.)

How the Mississippi Bubble Formed

After King Louis XIV’s death in 1715, France was heavily in debt, which had accumulated due to Louis XIV’s lavish spending (Palace of Versailles) and also the War of the Spanish Succession (1701-1714.) Moreover, France had a coin shortage problem due to an inadequate supply of metals.

So the French government turned to John Law, a Scottish economist and adventurer who came from a banking family.

Law convinced the French government to use paper money. Paper money was more convenient in terms of carrying large amounts of money, and it would also solve the government’s coin shortage problem.

Law then created a national bank, where people deposited their gold in exchange for notes. In theory, the notes would be equal in value to gold since they represented gold.

However, the government would go on to print so much paper money over the next few years, that instead of a gold-to-paper ratio of 1:1, it was 1:5, meaning that if everyone went to the bank to exchange their notes for gold at the same time, only twenty percent would be made whole–a disaster waiting to happen.

Anyway, this national bank, called Banque Générale Privée (General Private Bank), was established in 1716. It would later be called the Banque Royal (Royal Bank) in 1718, when the bank’s notes were guaranteed by the new king, Louis XV. Paper money by then had become France’s official currency.

From Mississippi Company, to Company of the West, to Company of the Indies

John Law wanted to create wealth, so he devised an idea. Louisiana in North America was named after the late Louis XIV. Law imagined there were many natural resources to mine there. If he created a company that would be in the business of retrieving those valuable resources, funded by raising capital through a public offering, then everyone could get rich.

In 1717, under John Law’s direction, the Royal Bank purchased the Mississippi Company. The Mississippi Company held a monopoly on commerce in Louisiana–French-owned territory in North America’s Mississippi River Valley.

After Royal Bank acquired the Mississippi Company, the company’s name was changed to Compagnie d’Occident (Company of the West.)

In 1719, the company had expanded to monopolize the entirety of France’s colonial trade, and so the company’s name was changed again to reflect the expansion. The new company name was Compagnie des Indes Orientales (Company of the Indies).

Shares are issued to the public

When shares of the Mississippi Company were issued to the public, John Law exaggerated the stock’s investment potential to excited investors.

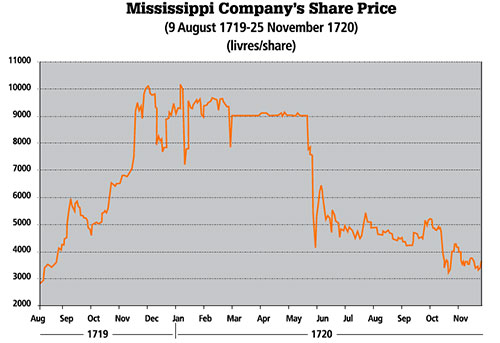

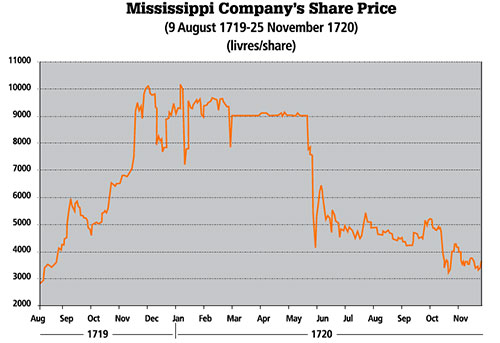

When the share offering sold out, shareholders traded amongst each other. This process of share offerings to the public and frenzied speculation was repeated several times, and the share price of Mississippi Company skyrocketed from 500 to 10,000 livres. This valuation was fundamentally unjustifiable, as Louisiana was never developed as originally planned. Yet in just a 4-month period in 1719, the company’s stock rose from 3,000 livres to 10,000 livres.

How the Mississippi Bubble Burst

During the height of the bubble, a prince went to the bank with his paper notes; he wanted to exchange them for gold. The gold had to be hauled away on 3 wagons.

Word began to spread that the bank did not have enough gold to back the notes. As mentioned earlier, only one-fifth of notes was backed by gold. This led to a bank run. In response, the government passed a series of royal edicts: printing money and selling gold was now illegal. Also, the bank was closed to prevent withdrawals.

Since it was now clear to the public that the notes were less valuable than originally assumed, Mississippi Company’s stock began to decline, too. Many millionaires lost their entire fortunes, and a number of them committed suicide.

In response, Mississippi Company offered to buy back shares to prop up the stock price. However, the buybacks were funded with more printed money, which was illegal and therefore corrupt.

As the notes declined in value, gold became even more valuable, which created a rise in crime and illegal trade in the black market–France had become a thief’s heaven. In response, the government legalized gold, which led to yet another bank run, bigger than the last. As people rushed to withdraw gold, 15 people died from the stampede.

Aftermath

The Mississippi Bubble popped and the market crashed. Many millionaires lost their entire fortunes. France was forced to raise taxes. Broad markets were affected. France and neighboring countries plunged into a depression, which laid the groundwork for the French Revolution. John Law fled France; he was scapegoated for the debacle and exiled.