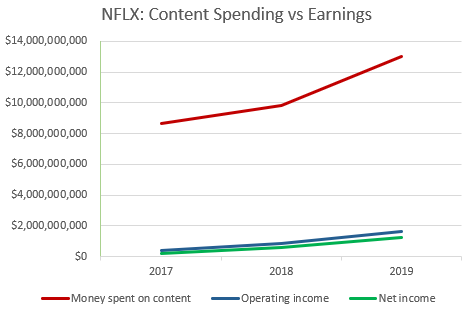

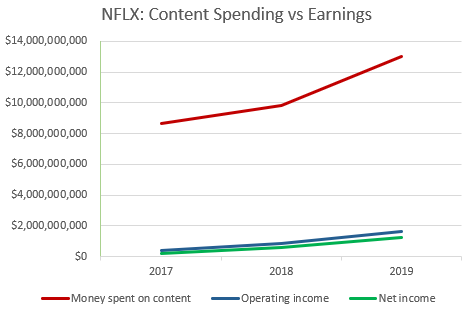

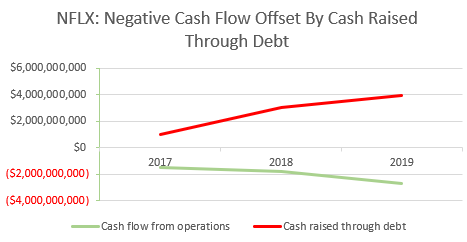

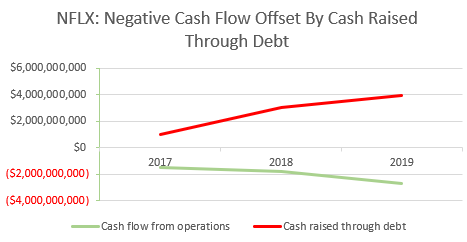

A business without cash flow is useless to shareholders. Headline earnings and revenue growth are irrelevant if there’s no chance of cash actually being returned to its owners. In the case of Netflix, there is no cash to return to shareholders despite all the top and bottom line growth. All the money Netflix earns – and more – must be reinvested back into new content to keep subscribers satisfied and prevent subscriber loss, or churn.

Negative cash flow is not always a deal-breaker. Many businesses have positive earnings and negative cash flows due to the necessity of reinvesting earnings back in the business. That’s how growth is fueled. But eventually the reinvestment stage ends, the business matures, and cash begins to be returned to shareholders through dividends and share buybacks.

I don’t see when this will realistically happen with Netflix because the cycle of reinvesting in content is a hamster wheel – there’s no end in sight. Without the constant investment in content, customers become dissatisfied and eventually cancel their memberships. With original content value being only 17% of Netflix’s content portfolio at the end of 2018, there’s still a lot more necessary spending to do before Netflix can afford to slow down.

Netflix’s Tapeworm Business Model

The problem with Netflix’s business model is that it’s a “tapeworm” business model. They spend money on content, feed it to the subscribers, but the subscribers never get satiated and they’re perpetually hungry. Spend $200 million and years of effort on a TV series? Subscribers binge watch the show in a single weekend. Rinse, repeat. If Netflix doesn’t continually produce new content, subscribers eventually become disengaged and cancel their memberships. It’s not a sustainable business model.

Unfortunately, there’s also a limit to what Netflix can charge before competitors start to look a lot more appealing.

In this negative cash flow model, everyone wins except the shareholders of Netflix stock. The customers win, content producers win, management gets paid (as they should), but the shareholders are the ones who stand to lose the most in this never-ending cash vortex. At current valuations, Netflix cannot afford a single misstep, and every piece of news must be spun positively. It is up to shareholders to see through the false bravado and make the right decisions for their financial future. Is the risk-reward on NFLX good enough? I don’t think it is.

No Margin of Safety: “One Black Swan Away From Destroying Everyone’s Retirement Accounts”

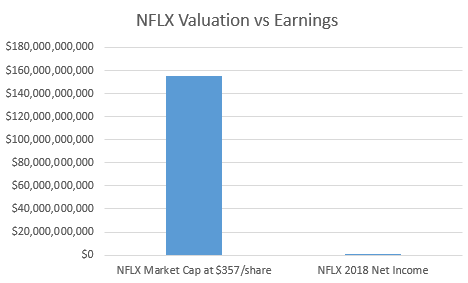

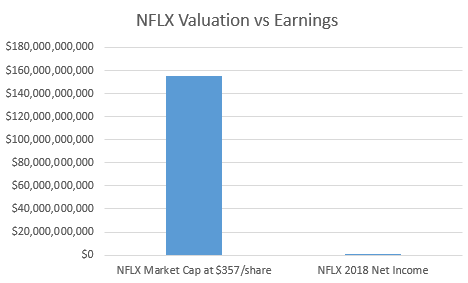

If you buy a stock cheap enough, you can be wrong about a lot of things and still make plenty of money; that’s the margin of safety, and it’s made many investors rich over time. But if you pay too much for a stock, even if the company does everything you believed they could do and more, you could still lose money. There are crowds of raving analysts waving around best-case scenario projections for NFLX, but even that growth is already priced in (unless you believe a mature NFLX will justify a 133X multiple.) The moment you think about NFLX on a terminal value basis sporting a mature-company, non-growth multiple, it becomes painfully apparent that there’s little intrinsic value that hasn’t already been priced into the stock.

At $155 billion market cap (about $357 a share), there is no margin of safety for NFLX. None. Paraphrasing a comment I read this morning, Netflix’s stock is “one black swan away from destroying everyone’s retirement accounts.”

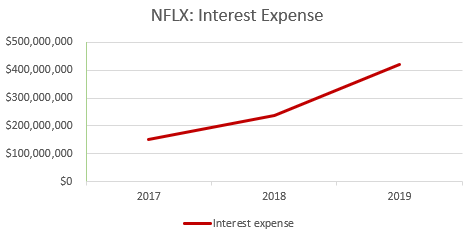

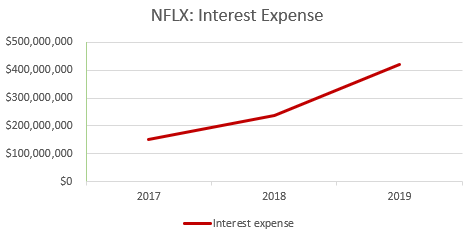

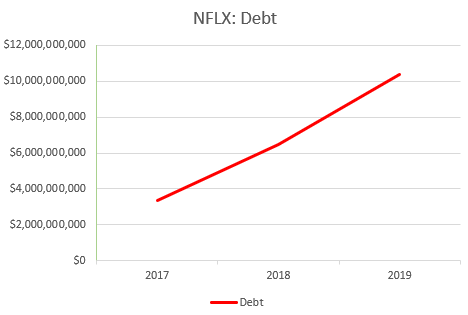

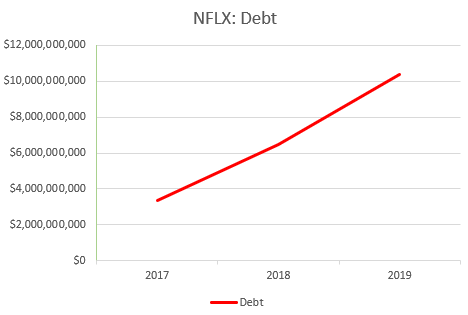

Too much attention is being focused on Netflix’s subscriber and revenue growth when analysts should seriously, seriously be more focused on valuation, downside risk, and the business model’s ability to actually return cash to shareholders in the long run. Analysts should also think hard about Netflix’s ability to raise prices in an environment of increased competition against more financially robust companies, not to mention how debt and dilution is being used to offset negative cash flow.

Shorting NFLX: Forget Timing – Position Sizing Is Key

Since Donald Trump became President, the looming market meltdown that was beginning to materialize in 2016 was averted and stocks continued to climb higher on lower corporate taxes and continued low interest rates. Lately, more analysts, money managers, and pundits have expressed increasing concerns about a looming market correction. The yield curve has inverted and cyclically-adjusted PE ratios are above 1929 and 2000 levels. Many investors have been going into cash.

It’s impossible to time the market, but it’s possible to prepare. So rather than going into cash completely, I’ve continued to buy undervalued stocks with long term growth prospects while hedging out the portfolio with short positions in select stocks. A NFLX short provides a great downside hedge in the event of a broad market correction or crash. When markets crash, stocks whose shareholders panic the most have profiles like Netflix: high-premium, negative cash flow businesses whose shareholders are overly optimistic.

Due to the over-optimism around the stock, a short on NFLX would require the ability to hold the position even if the stock rose further, without doing major damage to your portfolio. Therefore, position sizing is absolutely critical. The stock clearly does not trade on conservative estimates, so it should be assumed that it will not start doing so overnight. The best way to look at a NFLX short is a downside hedge rather than a core short position, with stock being preferable to options so that market timing does not become an impeding factor to success.

Disclosure: I am short NFLX. This article expresses my opinions only, and is not to be misconstrued as investment advice or a recommendation to buy or sell stock. For more information, refer to the Terms of Use.

Update March 2020: I am no longer short NFLX. I covered the position and used the proceeds to buy more PRPL. My thesis on PRPL can be found here.