I finally got a chance to read The Education of a Value Investor by Guy Spier over the weekend, and I wanted to take some time to review the book while the lessons are still fresh in my mind.

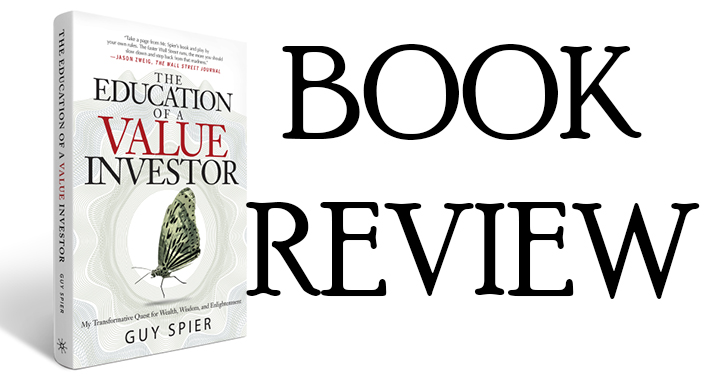

For those who don’t know, Guy Spier is an investor born in 1966. He manages his fund, Aquamarine Capital, from Zurich, Switzerland. He is notable for winning Warren Buffett’s annual charity lunch in 2008, along with his friend, Mohnish Pabrai. Together, they bid $650,100, with Spier contributing $250,000 to the pot. Spier also published a book in 2014 titled, The Education of a Value Investor.

Guy Spier is refreshingly candid in The Education of a Value Investor. In finance, there is a tendency for people to try and show off how intelligent they are. Yet Spier, who is clearly intelligent with a dual-degree from Harvard and Oxford (graduating at the top of his class for economics in the latter), goes out of his way to write instead about his insecurities, mistakes, and demoralizing setbacks on his journey to forge a career in finance and become more like his idol, Warren Buffett.

Although the book’s title gives the impression that its pages will be heavy on investing advice, it’s actually full of practical life advice that is applicable to anyone. Smoothly-written, I would recommend this book to anyone who wants to learn more about what truly matters in life, even if they aren’t interested in finance.

Here are 3 life lessons that I learned from The Education of a Value Investor by Guy Spier:

Lesson 1: Don’t make decisions based on your insecurities; live by an Inner Scorecard, not an Outer Scorecard

Everyone has insecurities they need to come to terms with before they can become the best versions of themselves. Often times, we—especially when we’re younger—don’t know how to deal with our insecurities in a healthy way. This can lead to missed opportunities/connections and inauthentic choices of action that can lead us down the wrong path. For Spier, it was the latter.

Guy Spier starts his book off with how he rendered himself unemployable before the age of 30 despite a dual-degree from Harvard and Oxford. In his desperation to look outwardly successful and distinguish himself from his peers, he quickly accepted a job offer from D.H. Blair, an unscrupulous retail brokerage firm that ended up shutting down for defrauding clients. It turned out the firm had only hired Spier to take advantage of his impressive academic credentials to make their business appear more legitimate to clients. Although Spier eventually realized this, he stayed at the firm because he was afraid of looking like a failure to his peers (a textbook case of commitment bias.) But when the firm inevitably shut down, Spier was out of a job; and due to his involvement with the shady firm, he had trouble finding anyone willing to hire him.

Throughout the book, Spier highlights his most embarassing mistakes and thoughts to the reader, not just for the sake of self-deprecating himself, but to drive home a very important life lesson: deal with your insecurities as soon as possible. They will be the death of you.

If you want to be happy, successful, and useful to other people, do not live to impress others. Instead, live to serve, however you can. Winston Churchill once said, “When you’re 20, you care what everyone thinks. When you’re 40, you stop caring what everyone thinks. When you’re 60, you realize no one was ever thinking about you in the first place.” When you compare yourself to others constantly and obsess over how you’re perceived (an Outer Scorecard), you become insecure.

So, whether you are young or old, make it your quest to deal with your insecurities as soon as possible, and come to terms with them in a healthy way, so that they do not mislead you down the wrong path.

Lesson 2: Knowledge isn’t exclusive to formal education. Assume that every person you come across has something to teach you, even if they received less formal education than you. Learn from everyone.

In the chapter titled “The Perils Of An Elite Education”, Spier reflects on his jobless days (after D.H. Blair shut down) and how he had to transform himself internally to change the trajectory of his life. He writes:

What I really needed to do was reeducate myself. Or, for that matter, un-educate myself […] one of the things I came to realize was that my ivory tower education had left me dangerously exposed and vulnerable.

The unsettling truth is that there are elements of an elite education that are positively a disadvantage. […] If you had an educational experience that was anything like mine, you—like me—may have to reprogram and rewire yourself in some fundamental ways.

Spier’s education had deluded him into thinking that knowledge and credibility could only be found in institutional schooling and expensive degrees. Worse, he had come to believe that anyone who had lesser academic credentials than he did wasn’t worth listening to.

For instance, Spier initially wrote off Warren Buffett when the legendary investor came to speak at Harvard during Spier’s first semester—the same man who would come to be Spier’s idol, and whom Spier would eventually come to spend hundreds of thousands of dollars just to have lunch with. Spier admits:

In my first semester at Harvard, Warren Buffett came to speak at the business school. In my ignorance and arrogance, I instantly dismissed him as some speculator who had just gotten lucky. After all, the theoretical models I’d learned at Oxford made it a self-evident truth that searching for undervalued stocks was pointless, given that markets were efficient. For me to grasp that he’d made a fortune precisely by exploiting market inefficiencies would have required me to ditch all of my painfully acquired academic models. And so I did what many people do when the facts disagree with their theories: I dismissed the facts and clung to the theory.

Spier also wrote off motivational speaker Tony Robbins because he didn’t go to college. Ironically, Robbins ended up being a huge catalyst in Spier’s personal transformation.

If not for the recommendation of his friends who held Stanford PhD’s, Spier never would have gone to the Robbins seminar that opened his mind. On this, Spier writes:

My intellectual snobbery made it easy to dismiss someone like Robbins. With all my education, how could I possibly learn anything valuable from this crass American? I don’t think I would have been willing to find out more about Robbins if these friends had not been Europeans with stellar academic pedigrees. I hate to admit this because it exposes the shallow intellectual values that I had at the time. For me, the beginning of wisdom was to drop these narrow prejudices so that I could begin to learn from everyone.

Attending Robbins’ seminar, Spier learned a three key lessons that changed the trajectory of his personal development:

- Transparency and authenticity is the key to bonding with others and gaining their trust. Even after signing up for Tony Robbins’ seminar, Spier was initially suspicious of Robbins’ motives, and therefore unresponsive to his teachings. That is, until the self-help guru told the crowd bluntly: “Look, I’m an American just like you. My motivation is to be happy and successful and to live the best life I can. And like most of you, I also want to make money and be rich. Richer than I am today. A big part of how I do that is by running seminars like this. But as much as I want to get richer, even more than that, I like helping people. And I know that I can teach you things that will help you, and that are worth much more than the entry fee.” Witnessing this upfront candor about his intentions sold Spier on Robbins, and also transformed him as a person. In fact, the reason Spier’s book is so refreshing to read is primarily due to how candid he is about things that people in his position wouldn’t be willing to admit.

- Be open-minded. Spier’s positive and transformational experience with Robbins inspired him to become more open-minded. Aspiring to “learn from everyone,” Spier began to explore other self-help gurus, including Dale Carnegie, who notably helped Warren Buffett get over his fear of public speaking. In this manner, Spier set out on a path that would reconcile his innate intelligence with moral goodness.

- Role models are powerful tools for personal development. Spier writes, “From Tony Robbins I had discovered the power of modeling the habits of successful people”. This led Spier to study Warren Buffett. As he read Buffett’s annual shareholder letters, he began to see his wisdom, not just in investing, but in life, too. Besides adopting Buffett’s style of value investing as his own, Spier also came to ask in his everyday life, “What would Warren Buffett do if he were in my shoes?” Spier had come full circle, from an arrogant young man who believed he was superior to others due to his educational background, to a humble student of life who wanted to learn from everyone.

Mohnish Pabrai. Despite his idolization of Warren Buffett, Spier writes that the person who influenced him most as an investor was Mohnish Pabrai, an Indian immigrant who yielded better returns on his investments than Spier despite not having attended a prestigious school. Pabrai, an entrepreneur, investor, and philanthropist, came to be one of Spier’s closest friends. (Pabrai had bid the lion’s share of their 2008 lunch with Buffett, but graciously offered Spier and his wife to join him and his family, even if Spier did not contribute equally to the bid. On this, Spier wrote that he had never been treated so kindly and generously by anyone else besides his own father.)

Warren Buffett. Spier also noted that Buffett had failed to gain admission to Harvard, and that during his and Mohnish’s charity lunch with him, Buffett “couldn’t have cared less where either of us had studied.” He also pointed out that Buffett valued his $500 diploma from a Dale Carnegie speaking course more than his Columbia Business School education; the former hangs proudly in his office, while the other does not.

Lesson 3: “Your environment is much stronger than your intellect.”

Everyone loves a self-made story, but the truth is, no one is truly self-made. No one is born from the womb with a Circle of Competence. Everything we are is given, learned, or inspired by others.

You need the help of others to become successful.

As Guy Spier began to study value investing, his father took notice of his son’s passion and gave him $1 million to manage in 1996. This money was used to start the Aquamarine Fund in 1997, which Spier still manages today.

Spier also met one morning a week with “the Posse,” a collection of investors that included Joel Greenblatt and occasionally Bill Ackman.

During the Posse meetings, at least one person would present a stock idea, which the others would debate and dissect. On this, Spier writes, “This expanded my knowledge beyond anything I could have learned from a textbook or MBA course. We not only learned more about investing but gained a deeper understanding of each other—about what made us tick, or not tick. The Posse’s meetings produced friendships that are a reward in their own right.”

Spier reflects:

“I began to surround myself with a ‘mastermind’ group of investors who would become life-long friends and trusted sounding boards. It’s difficult, if not impossible, to become successful on your own.”

Where you live and do business matters

Guy Spier wrote in-depth about the “New York vortex” in The Education of a Value Investor, and how its influence on money managers can lead to sub-optimal decision-making and groupthink. He lauded Warren Buffett’s wisdom for setting up his headquarters in quiet Omaha, Nebraska rather than in New York City. Over a thousand miles away from Wall Street, Buffett effectively insulated himself from unnecessary distractions and the opinions of others. It allowed him to think in solitude and focus on the long-term picture independently and calmly, without anyone else contaminating his judgment.

However, despite his attempts to model himself after Buffett, Spier initially believed that he could “outwill” his environment, which led to strategic mistakes, a few sub-optimal decisions, and even an investigation from then Attorney General, Elliot Spitzer.

For instance, Spier was convinced by lawyers to structure his fund like other firms in New York City despite knowing that Buffett had used a superior structure in his Partnerships that aligned better with the interests of investors. Spier also shorted stocks, and ended up being roped into an investigation with some other fund managers regarding stock manipulation. Although the investigation went nowhere, it cost Spier money and distress.

Spier also writes about how he got “carried away with the whole combat sport of shorting a stock.” He recollected how he would go on conference calls to ask “pointed questions designed to highlight the company’s weaknesses” and the way he used the New York Times to proliferate his bearish messages:

“These were valid and important points, and investors had the right to know that the company was riskier than they thought. But there was a righteous (or self-righteous) indignation in my attitude that didn’t reflect well on me. In retrospect, I feel as if I lost my way and acted like a petty tyrant. My goal as an investor is to compound money for my shareholders, not to pick unnecessary fights or conduct myself like an avenging moral crusader.

[…]Life is too short for this sort of conflict, and these investment gains didn’t justify the headache. Odd as it might sound, I also think we often bring bad things on ourselves when we point the finger at others or act in a tyrannical way. In my experience, it’s karmically better to focus on the positive and act as a force for good instead of getting gratuitously embroiled in acrimonious battles.”

In the end, Spier only ended up shorting 3 stocks (all of which made him money) before ceasing the stressful activity:

“I yearned to find a path that was simpler and better for my mental health. In New York, I had drifted off course, allowing myself to get caught up in a series of unnecessary distractions. But I was starting to realize that I didn’t need a fancy office; I didn’t need to attract more assets to my fund as a way of proving to others (and myself) that I was a big shot…”

“Part of the problem was that it was so easy to get sucked into the vortex of the New York financial world, with its skewed values and seductions. I felt that my mind was in Omaha, and I believed that I could use the force of my intellect to rise above my environment. But I was wrong: as I gradually discovered, our environment is much stronger than our intellect. Remarkably few investors—either amateur of professional—truly understand this critical point. Great investors like Warren Buffett (who left New York and returned to Omaha) and Sir John Templeton (who settled in the Bahamas) clearly grasped this idea, which took me much longer to learn.”

A few other things I learned from Guy Spier’s The Education of a Value Investor (without giving away the entire book.)

There are some crafty tips and tricks in the book for investors too, in regards to making connections and work flow. For example, Spier talked about how he would buy a share of a mutual fund so he could attend the annual meetings. Regarding work flow, Spier detailed how he puts his Bloomberg Terminal in a separate room from his office without a chair so that he’s unable to spend the entire day looking at stock prices and driving himself mad.

In regards to specific advice for investors, Spier does a great job in identifying the psychological shortcomings of the human brain and remedying them using practical tactics. Towards the back of the book, Spier shares his own investing rules. One investing rule that Spier has which you might find surprising is, “Don’t talk to company management.” Why? Spier reasons that CEOs and other directors tend to be great salespeople, which can distort your perception of the facts.

Still, the best lessons in the book are by far about life and people: the difference between givers, takers, and matchers; the joy of being a giver and surrounding yourself with givers (Mohnish Pabrai a great example); and how Spier learned through his own life experience that

Conclusion, Final Thoughts

Spier’s honesty and willingness to self-deprecate in order to drive home crucial life lessons for the benefit of the reader is truly the magic that holds The Education of a Value Investor together.

For instance, Spier wrote about how he used to be jealous of Bill Ackman–a fellow Harvard graduate–because Ackman was managing more money and getting more attention. Spier even confessed that, as a young man, he would use Latin phrases to intimidate people with his intelligence when he got nervous.

While some of Spier’s admissions were borderline-cringing at times, there is not a single person reading this who hasn’t done something cringe-worthy before themselves. So I definitely respected and admired Guy Spier for his willingness to be truly authentic and transparent, especially coming from the hedge fund world where its participants are often referred to as “Masters of the Universe.” Very few people–regardless of what field they’re in–can be that real.

The moral of Guy Spier’s The Education of a Value Investor is: people aren’t a means to an end, but an end themselves, and that money alone cannot buy happiness. Don’t live to impress others or seek validation–you’ll end up lost and miserable. Instead, focus on becoming the best version of yourself you can be, and figure out how you can be most helpful to humankind. Conduct yourself authentically so that you can look yourself in the mirror and know you are doing your best, rather than fixating on your insecurities and overcompensating out in the world as a result. Also, being humble allows you to set yourself free: free to be wrong and change your mind; free to continually evolve; free to reject the well-traveled path in order to forge your own.

Overall, The Education of a Value Investor is easy to read and smoothly-written; I read it in just three sittings because I found it so enjoyable to read. I even convinced my wife to read it too, and she thoroughly enjoyed it, despite not being a finance person. Indeed, I was surprised to see that on nights where she would usually be watching her favorite show, she would be reading the book instead for hours.

Buy The Education of a Value Investor by Guy Spier

If you are interested in reading Guy Spier’s The Education of a Value Investor for yourself, you can check the price here.

If you already own the book, let me know what you thought of it in the comments below!