In a previous post, I wrote about the advantages of investing in micro caps. In this article, I’ll detail the downsides of micro cap investing.

Less Media Coverage

Most people don’t follow micro caps, so the media at large doesn’t cover them. That’s because when articles or videos are made about a micro cap stock, very few people view it. Less viewership means less advertising income, and advertising is a big bulk of what pays the media companies and journalists. On the other hand, writing about a stock like AAPL or AMZN addresses a huge market of people who are hungry for information, both on Wall Street and Main Street.

Less Analyst Coverage

Since analysts are costly to employ, there is little incentive to have them digging into micro caps, especially since the firms they work for are typically too big for a micro cap investment to make a dent in their overall returns. When you have a hedge fund managing $10 billion of assets under management, a $20 million micro cap is not on the menu. That’s because $20 million is only 0.002% of $10 billion. Even if the $20 million stock ended up being worth $300 million, it wouldn’t move the needle for the hedge fund. For them, there’s bigger fish to fry. Not to mention that spending 0.002% would mean buying out the company, and that’s not what investment companies are typically trying to do.

Less Information

The great thing about stocks with market caps over a certain size is that they must always list the risk factors of their business and stock in a dedicated section of their annual report – Item 1A.

Smaller companies of a certain type, however, are exempt from reporting risk factors. Where risk factors are usually listed, you may see something along the lines of: “Smaller reporting companies are not required to provide the information required by this item.”

This means you need to take it upon yourself to figure out the risk factors yourself and temper your initial excitement about any perceived upside. This can be hard to do when no one, not even the company, is detailing the risk factors.

Poor Liquidity

Most micro cap stocks have poor liquidity, meaning they are hard to trade in and out of. This is because the giant institutional investors that drive liquidity in larger stocks aren’t present in the micro cap markets.

Therefore, if you are desperate to sell a micro cap, you’re likely to get a bad price for it. To sell a large block of stock using a limit order requires waiting, sometimes weeks, months, and maybe even a year depending on your asking price.

This means that if you want to invest in micro caps and reap its benefits, you should have a long-term view and plenty of conviction.

Susceptible to Manipulation and Prone to High Volatility

Due to poor liquidity and their small size, it doesn’t take huge amounts of money to move a micro cap stock significantly. Micro caps can swing 20% in either direction in a single day for no apparent reason at all besides the fact that shares are illiquid. Even a $50,000 order can move the stock greatly, whereas millions of dollars can fail to move the price on a large stock like AAPL.

If you have the right mindset, the volatility of micro caps can be taken advantage of. For instance, you can buy shares at a very cheap price during periods of fundamentally-unwarranted, overexaggerated sell-offs. During times like these, you can get recession prices for a micro cap stock during an S&P 500 bull market. You can also take advantage of overdone rallies by selling into them at profits greater than your own price target.

Less Financial Resources

Due to their size, micro cap companies have less financial resources to compete with larger companies. They generate smaller profits, retain smaller earnings, and have less to invest in their business growth as a result. If there is a larger competitor in the space and the micro cap company doesn’t have some sort of moat, they can easily be run out of business. Indeed, most of the micro cap space is littered with uninvestable companies, but the rare good ones – although they often require a leap of faith – can make you rich.

Not Usually On Major Exchanges

Instead of being listed on major exchanges such as NASDAQ or NYSE, micro cap companies will often be listed over-the-counter.

OTC Markets Group is the most notable financial market for OTC stocks, organizing them in three different markets based on risk profiles: OTCQX, OTCQB, and Pink.

- OTCQX is for established, investor-focused companies. To qualify for listing, the company must demonstrate compliance with U.S. security laws, be current in disclosure, follow best practice corporate governance, and meet high financial standards.

- OTCQB is for early-stage and developing companies. To stay listed, they must be current in their reporting, undergo annual verification and management certification process. They must also pass a $0.01 bid test and cannot be in bankruptcy.

- OTCPK (Pink) gives access to companies that have no disclosure requirements and are not required to adhere to any financial standards. Delinquent, distressed, penny stocks, shell companies, and dark companies exist here.

There are many cases of OTC stocks that uplist to NASDAQ that you will find throughout the micro cap universe. Furthermore, not all micro caps trade OTC. Netflix and SiriusXM were both NASDAQ-listed stocks that ended up being multi-year, multi-baggers.

Often Speculative

Although there are some mature and cash-flow positive micro cap companies, many of them are not. Many micro cap companies are looking to grow and expand their business, and so many of them aren’t cash flow positive. Therefore, micro cap investing is often a highly speculative activity.

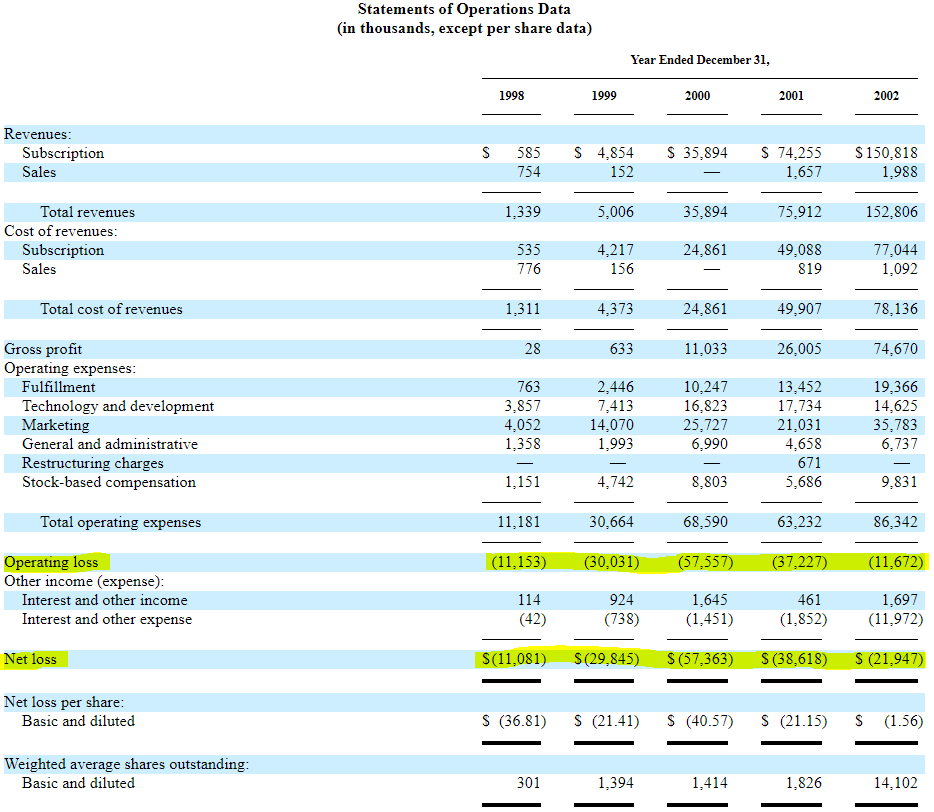

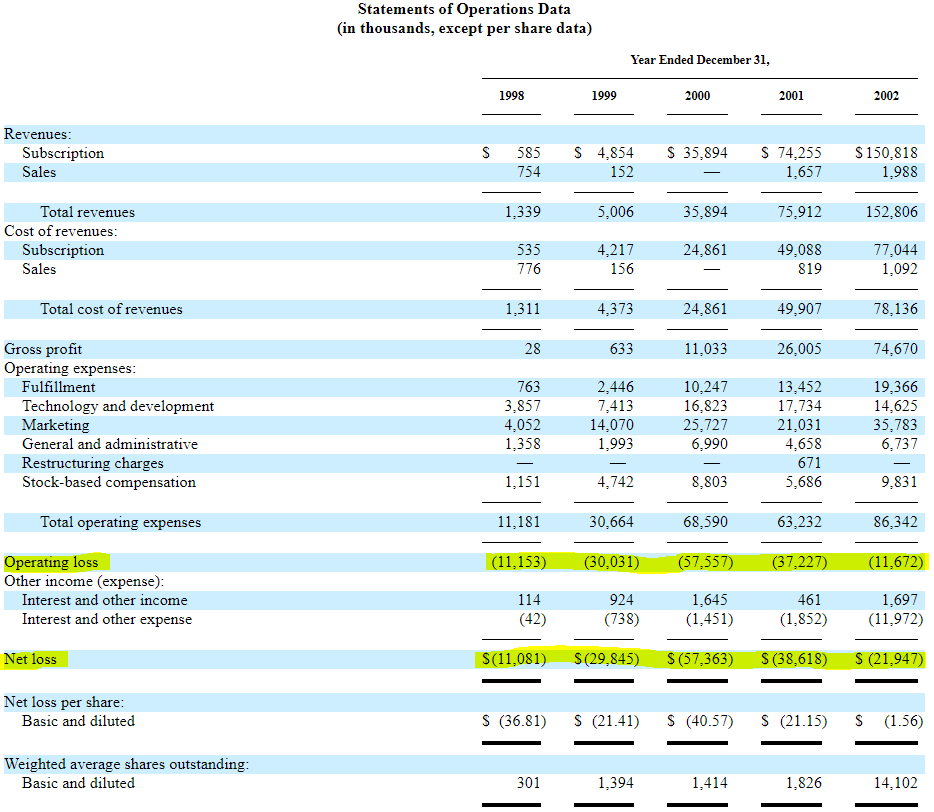

Netflix is probably the most recognizable company today that was once a micro cap. Over the past 16 years, Netflix investors multiplied their investment value by 1,250X. But in 2003, Netflix’s income statement looked like this:

Source: 2003 Netflix Annual Report

Note the multi-million dollar net losses and operating losses. Not many people would feel comfortable putting their money into a company with this kind of financial statement, even if the revenues were growing.

Value investing legend, Benjamin Graham – who completely discounted a company’s future prospects and only focused on what he could make if the business were liquidated – surely wouldn’t have bought a stock like this.

To invest in a company like this requires transcending the present and putting a price on future potential, which is hard to do and prone to many cognitive biases. Indeed, many of the best micro cap growth investments will require taking a real risk on the company’s ability to execute, and that conviction (or willingness to see what happens) is built on trusting your research and logically-sound opinions about the company’s future.

Closing Remarks

Investing successfully in micro caps requires a high degree of competence and fact-checking to avoid making poor investment decisions and losing all your money. You must have a firm grasp not only of accounting, business appraisal and valuation, but you must also have the willingness to dig and understand the business and corresponding industry you are analyzing.

In the micro cap world, making mistakes are costly, and if you don’t know how to structure a portfolio properly or manage risk, micro caps can be outright deadly. Price-based stop losses are out the window because there’s no liquidity. You have no analysts to compare your work with or feed you information. You have no media personalities to make you feel good about owning the stock. It’s the Wild West. But that’s why the profits are incredible if you can own the right ones.