What is FOMO trading?

FOMO stands for “Fear of Missing Out.” When you chase an expensive stock and buy it simply because it keeps going up–despite having determined that the stock is too expensive or not within your circle of competence–that’s called FOMO Trading.

FOMO trading is triggered by the irrational fear that you will be the only person who failed to make money on a particular investment trend while everyone else is enjoying steak & lobster dinners, yachts, and sports cars with their newfound wealth.

Recent Example of FOMO Trading: ROKU

The most recent, prominent example of FOMO trading I can think of in recent weeks is ROKU. The stock went to $175 a share and quickly crashed to $100 in less than a month.

If left unchecked, FOMO trading can lead to being swept up by the crowd’s madness. It’s been well-documented that emotional investing/trading leads to buying high in euphoria, selling low in despair, and below-average results, as you can see here with ROKU.

GPRO is another example:

There are two tricks that FOMO plays on the mind:

- That “easy money” might actually exist. And that…

- The returns of your peers matter. (It doesn’t. Being consistent with your process matters more.)

How do value investors deal with FOMO trading? Actually, they don’t.

This may surprise traders and speculators, but true value-oriented investors never get tempted to engage in FOMO trading. That’s because investors care about future cash flows, not market-driven capital gains.

Value investors don’t experience FOMO the same way traders do because of their strong beliefs about margin of safety. Unlike traders and speculators who make buy and sell decisions based on what the stock is doing, investors are only concerned with (1) how much cash they think they’ll receive from the business over its lifetime and (2) the price they pay to receive that cash flow.

For value investors, the market isn’t a guide, but something to be taken advantage of when quoted prices present a margin of safety. The market is also something to be ignored when there is no margin of safety. In other words, if an investment makes sense, a value investor is going to buy the stock regardless of what other people think, and if an investment doesn’t make sense, they’re going to “pass” regardless of what other people think.

So if anything, investors have more issues with RFMO: being “Ridiculed For Missing Out” on certain investment opportunities.

How Warren Buffett was RFMO’d for his avoidance of Tech Stocks, then heralded as an Oracle.

When Warren Buffett spoke at Sun Valley in July 1999, he was ridiculed by tech gurus who had made a killing in the Dot-com bubble. During his presentation, Buffett denounced the great bull market of the 1990’s and prophesized that the market would crash.

In Alice Shroeder’s Snowball, Buffett’s biographer describes the offended rumblings of the newly-rich tech gurus who were in attendance:

They believed that Buffett was rationalizing having missed the technology boom, and they were startled to see him make such specific predictions, prophecies that surely would turn out to be wrong. Beyond his earshot, the rumbling went on: “Good ol’ Warren. He missed the boat. How could he miss the tech boat? He’s a friend of Bill Gates.”

8 months later, the Dot-com bubble burst and NASDAQ lost 78% of its value. $5 trillion of market value was erased between March 2000 and October 2002.

Waiting for Vindication

It can be frustrating for even-minded value investors to watch speculators roll in profits during bull markets while their portfolios lag behind, especially when they’re being criticized for it. But when frothy markets crash, value investors are heralded as far-sighted geniuses while the speculators are made out to be gullible fools. During the Dot-com Bubble, Warren Buffett was considered a dinosaur for his unwillingness to hop on the gravy train of easy money, but when the markets crashed, his reputation was further solidified.

Unfortunately, this cycle of ridiculed-to-glorified can take years before a value investor’s wisdom is vindicated. How do they cope in the meantime?

When a value investor chooses not to invest in a stock, it usually boils down to two major reasons: (1) risk management, and (2) the belief that a better investment can be found.

Everyone Misses Out On Something

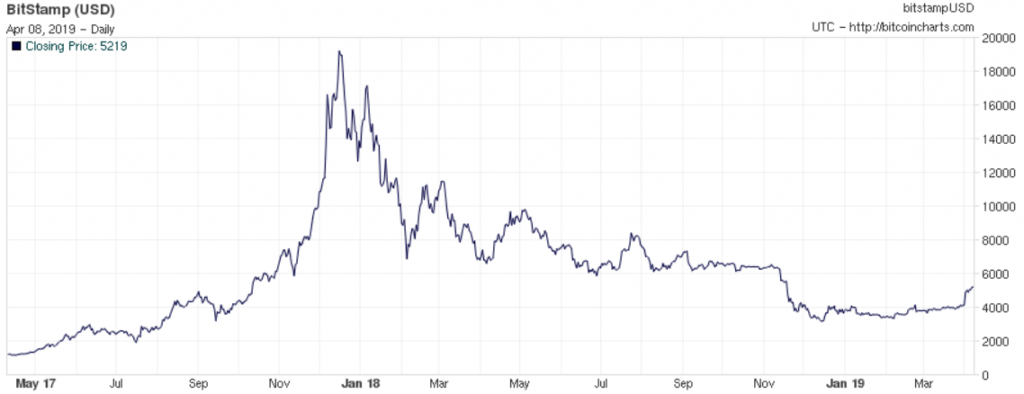

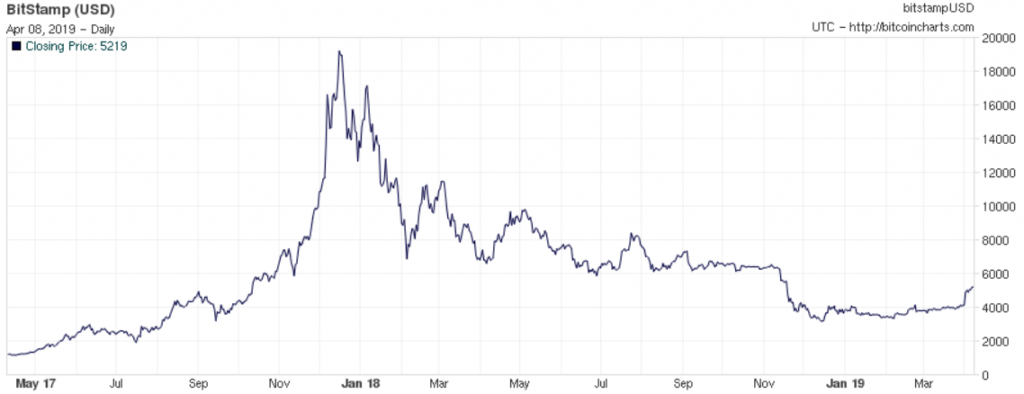

Value investors probably didn’t profit on Bitcoin and 9X’ed their money as it rose expontentially into the end of 2017, but that doesn’t mean they didn’t make money in other things. Also, they didn’t participate in Bitcoin’s following crash and poor performance throughout 2018:

Missing out on profits made from irrational bubbles is the price a value investor pays to maintain their even-minded, rational approach and conserve their capital for their best ideas.

Caveat For Money Managers

Even if a value investor has the self-control to stand firm in their beliefs and not chase gains with the rest of the crowd, their clients might do silly things due to FOMO such as pulling money out of the fund.

This is why it’s important to only take on clients who understand your philosophy and have similar beliefs. It is also wise to structure your fund in a way that protects your clients from themselves during emotional times where regrettable mistakes are most commonly made.