Netflix’s first mover advantage was propelled on borrowed wheels – the licensed content of competitors. Now competitors want their wheels back, and Netflix is racing against time to build new ones, and it’s coming at a high cost. They’re spending money they don’t have, and spending more than any other competitor. Today, Netflix raised another $2 billion in debt on top of the $10.3 billion debt they already have. Moody’s rated the bonds “Ba3”, which is 3 levels below investment grade. In other words, junk bonds.

NFLX bulls have done a convincing job of painting Netflix’s unsustainable content spending as a “conscious investment in growth.” But Netflix has no choice but to spend uncontrollably. They are not spending to grow, they’re spending because they’re fighting for survival.

Most Netflix members are not watching Netflix originals. According to Nielsen data compiled for WSJ, 72 percent of viewing minutes was spent on content not produced by Netflix. Worse, 40 percent of that content is owned by competitors NBCUniversal, Disney, and Warner Media. Even worse, all three are launching subscription services in the near future. Disney (DIS) is launching Disney Plus on November 12. Warner Media, owned by AT&T (T), is launching later this year, too. NBCUniversal, owned by Comcast (CMCSA) is launching next year.

Friends and The Office are Netflix’s most-watched shows – neither are owned by Netflix. Friends is owned by Warner Media, and Netflix had to pay over $100 million to keep it throughout 2019 – over three times what they were originally paying. The Office is owned by NBCUniversal, who has already begun discussing the removal of the show from Netflix when the contract expires in a couple of years.

With most of Netflix’s licensed content at risk of being pulled from the platform when competitors launch their own services, Netflix only has two logical choices: continue to get price-gouged, as they were with Friends, or create their own content. The only smart choice for the long term is the latter – create as much content as possible, as fast as possible, before their competitors eventually strip Netflix of 83% of its content (only 17% of Netflix’s library is comprised of company originals in terms of value at the end of 2018.)

Netflix is doing just that. Content spending has risen dramatically over the years. According to analysts, Netflix will spend $15 billion on content in 2019. In comparison, Disney has only allocated $1 billion for its first year. NFLX bulls took this as confirmation that there is nothing to worry about on the long side, but they are wrong. Competitors have the ability to spend just as much as Netflix and go into just as much debt, too, but none of them have as much at stake as Netflix does, so they choose not to. That explains why their approach has been more tempered and conservative compared to Netflix. Disney for example, expressed that their goal is not to be bigger than Netflix or compete with them on content spending. “We’re not after being bigger than Netflix or beating Netflix […] We’d just like to serve customers well,” Kevin Mayer, chairman of direct-to-consumer and international, said at the APOS conference in Bali, Indonesia.

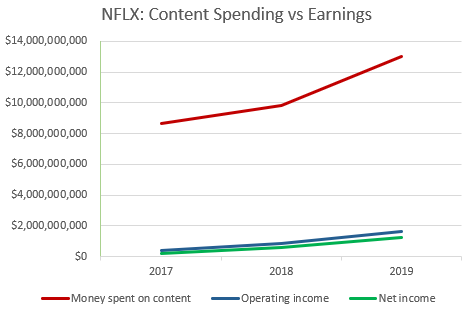

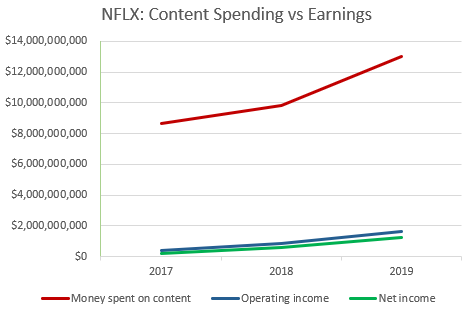

From an economical standpoint, more spending doesn’t necessarily make Netflix superior. In fact, the less content expenditure required to keep subscribers loyal, the more profitable a streaming business can be. The chart below highlights how Netflix’s increased content spending has not led anywhere near a 1:1 increase in income, which shows that Netflix’s content expenditure is a poor return on investment (which is typical of the industry – spending more money doesn’t correlate with hit-making (e.g. Alexander, 2004, was received horribly despite its star-studded cast and $155 million budget.)

Bulls argue that price increases can bridge the gap, but with so many friction points starting to develop on the bull thesis (valuation, competition, piling debt, increasingly-expensive licensed content that will soon be taken away – which has led to being forced to spend exponentially more than competitors in a race to develop new content), the price-increase oasis is starting to look more like a mirage than a guaranteed destination to support a continued price rise in the stock.

The question is not whether Netflix will continue to attract more subscribers – they will. The question also isn’t whether their competitors can “kill” Netflix – they probably won’t. The question is whether owning NFLX stock will prove to be Pyrrhic victory for shareholders.

A Pyrrhic victory is a victory that inflicts such a devastating toll on the victor that it is tantamount to defeat. Someone who wins a Pyrrhic victory has also taken a heavy toll that negates any true sense of achievement.

– Wikipedia

In my view, the growth narrative is over for Netflix. Defense, not growth, is the only logical explanation for such aggressive content spending on Netflix’s part. Unlike Amazon (AMZN), Netflix doesn’t have some never-before-seen, multi-decade master plan that justifies their current valuation. Netflix is sacrificing the queen to save the king – nothing more. They’re spending ever-increasing billions on content because they will soon be losing a lot of content. For every subscriber acquired, even more debt is placed on the company’s back to keep them. Keep them, they probably will (I’m not canceling my Netflix), but at what cost? Debt continues to pile up and cash flow continues to be negative. Therefore in the coming months and years, I think there is a higher chance of NFLX’s stock price halving than doubling. No one can predict the market, but all the evidence is pointing that way, and the fundamentals can only be ignored for so long.

Disclosure: I am short NFLX. This article expresses my opinions only, and is not to be misconstrued as investment advice or a recommendation to buy or sell stock. For more information, refer to the Terms of Use.

Update March 2020: I am no longer short NFLX. I covered the position and used the proceeds to buy more PRPL. My thesis on PRPL can be found here.

Great article! Thank you 🙂