Elon Musk pointed out in an interview that it’s “mentally easier to reason by analogy rather than first principles.” Regardless of what detractors might say about him or Tesla these days, it’s an enlightening statement.

In investing, analysts often reason by analogy. It’s a common practice to value a stock by comparing it to its industry peers.

For instance, let’s say an analyst wants to cover the e-commerce sector. So he gathers up all the e-commerce stocks and averages out their price-to-earnings ratio. For the sake of this example, let’s just say the average PE of all e-commerce stocks is 38. The analyst then looks at Amazon with its 76 PE and eBay with its 19 PE, and concludes that eBay is cheap and Amazon is expensive. He’ll then assume that Amazon will somehow “revert to the mean” of its peers and draw up scenarios on how that might happen: maybe Amazon grows its earnings, or maybe the stock price falls.

That’s one form of relative valuation although the rest are similarly quantitative. Although you can cover a lot of stocks in a short amount of time using this method of analysis, there are major drawbacks to this kind of analysis because it is not built on first principles.

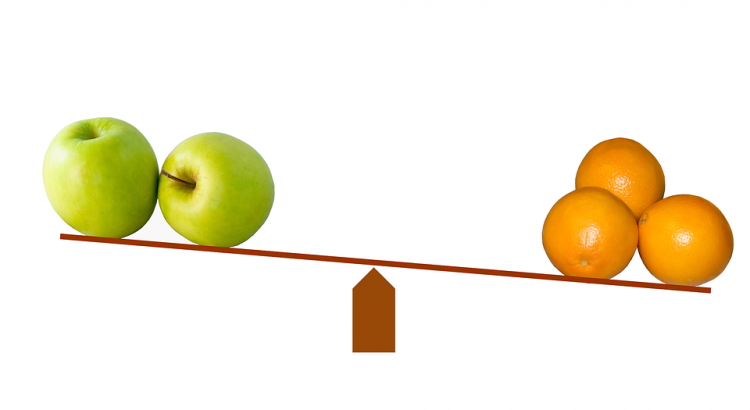

The first flaw with this kind of analysis is that even if two companies are in the same industry, they are often still very different. In the case of Amazon and eBay, they have different histories, cultures, and philosophies. They have different methods and capabilities for tackling the e-commerce space. Moreover, Amazon has a lot more business arms than eBay. Therefore, comparing the two companies in order to figure out if one is cheap or expensive is not a logical way of determining that.

The second flaw in relative valuation is that you’re forced to assume that one of the stocks are valued correctly. But what if the entire basket of stocks in an industry are overvalued, as was the case during the Dot-Com Bubble? Relying on any sort of relative valuation method would have led to catastrophic results.

So what would be a method of valuation that is based on first principles? What would be a method of valuation that first starts with what we know to be absolutely true, and then building upwards from that foundation, like a pyramid?

The first principle in investing is that stocks represent businesses, and businesses can generate profits. These profits can be reinvested to grow the business or it can be distributed back to the shareholders, which is what you become when you buy shares of a stock.

The conclusion based on these first principles is that if you want to succeed in the investing game, you will want to buy the future profits of the company in question at a discount. From there you would have to employ a method of estimating what you think those future profits will be. When you figure that out, you can decide what you think those future profits are worth. Whether you’re value investing or growth investing, you essentially want to buy a dollar for 20 cents. There are many methodologies on how to go about trying to do this, but as you can see, another first principle about investing is that there are no guarantees because you are dealing with the future, and the future is inherently unpredictable.

If you are not investing in this manner, you are most likely just playing the same game that everyone else in the stock market does, which is the “try and sell this stock you know nothing about to an even bigger idiot who knows even less about the stock than you do” game. And while some lucky people have made money doing that, it’s not reliably repeatable over the long run, which makes it no better than useless gambling.