“I have some extra money. Should I use it to pay off my debt or invest in stocks?”

If you have substantial personal/consumer debt (e.g. credit cards), you should focus on paying that off first before investing in any stocks. That’s because the average return for stocks historically–accounting for all the up years and down years–is about 10%, while most credit cards are going to have APRs well-above that, regardless of your credit score. And while stock market gains aren’t guaranteed, credit card interest is.

Imagine this scenario: you have $10,000 invested in the stock market compounding at 10%, but also have $10,000 of credit card debt with 15% APR.

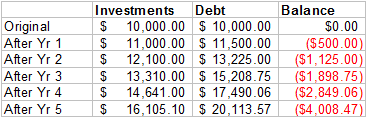

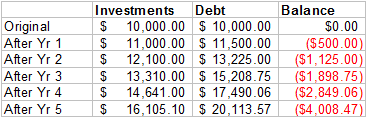

Here’s what your finances would look like after 5 years:

At the end of year 5, your investments earned you $6,105.10, but your debt more than doubled, accumulating an extra $10,113.57 in interest on top of your original $10,000 credit card balance. Not good.

In other words, you would have been better off taking your original $10,000 and putting it into debt in order to attain a $0 balance, rather than floating your debt and putting your cash into stocks in an attempt to out-pace your credit card debt. Indeed, at the end of five years, your decision to invest rather than pay off your debt cost you an extra $4,008.47 even after accounting for your investment gains. This is the power of compound interest; in this case, compounding worked against you because your debt was compounding at a rate of 15%, while your investments only compounded at 10%.

So the takeaway here is that if you have credit card debt, it’s wise for you to pay it off first before you begin investing your money. Even seasoned traders and investors who think they can achieve higher-than-average returns should think twice before making that gamble. Even if you are able to return more money from your investments, what if you don’t? This happens more often than you think. Can you live with that possibility, or will you kick yourself later for taking such a risk? That’s something you’ll need to consider, regardless of your investing/trading abilities.