If you want to invest in Canopy Growth Corp (NYSE:CGC)–the world’s largest marijuana company by market cap–but are concerned about overextended valuations and downside risk, consider buying shares of Constellation Brands (NYSE:STZ), the largest multi-category supplier (beer, wine and spirits) of beverage alcohol in the U.S.

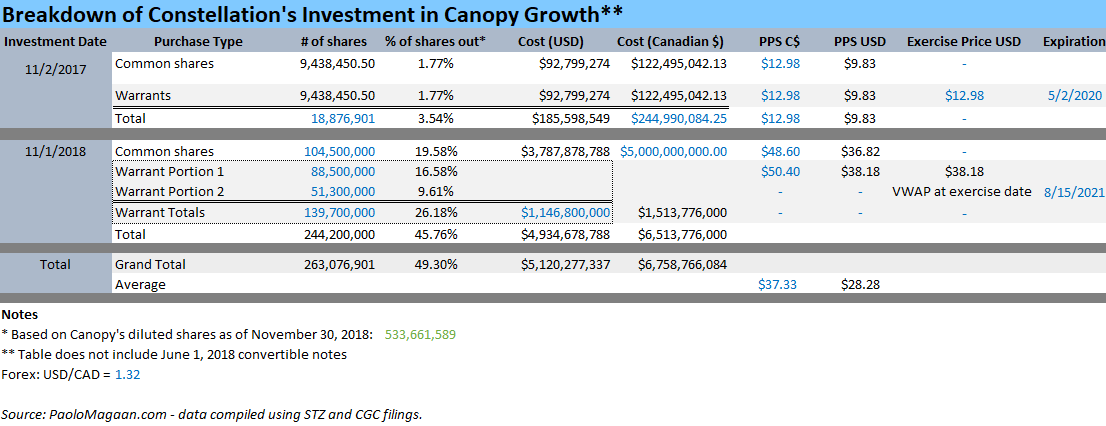

Approximately 90% of Constellation Brands’ investment in Canopy Growth was purchased at an average price of $28.28, more than 1/3 cheaper (34%) compared to CGC’s current price of $43.

While the average price of Constellation’s investment in Canopy will change over time based on several dynamic factors such as: the Canadian and U.S. dollar conversion rate, any future Canopy share dilution, any further investment by Constellation, and the exercise price of the warrants being tied to VWAP (which is the other ~10% of Constellation’s investment, labeled as “Warrant Portion 1” in the table above), the point is: if you missed the boat on CGC and are unwilling to wait for a lower price (which may never come), buying STZ gives you a better price and opportunity cost on CGC than what you can currently get on the market if you chose to buy shares of CGC outright.

But is it worth exposing your portfolio to Constellation Brands?

Not only did Constellation acquire a potentially-controlling stake of the world’s largest marijuana company at what turned out to be a discount—their own stock is undervalued by as much as 50 percent.

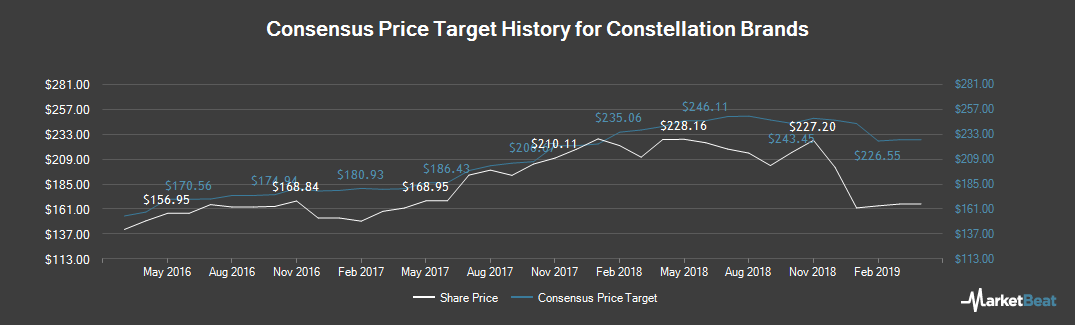

I valued Constellation’s alcohol business alone in its current form to be between approximately $223 to $262. This range was based on bearish and base-case scenarios using a multiple that assumed a reversion to the current industry average of 20.

Other analysts have pegged similar price targets on Constellation with the average price target of 26 analysts amounting to $227.83.

My valuation did not factor in any further growth in Constellation’s business, and I also chose not to speculate on the results of the disposition of their lower-end, underperforming wine brands. Both omissions create a margin of safety in my valuation because they do not skew the numbers in Constellation’s favor.

Why did Constellation’s stock, STZ, decline to $170 from April 2018’s high of $236.62?

In my view, the decline of Constellation’s stock price from April 2018’s high of $236.62 was driven by the exodus of legacy shareholders who (originally invested in STZ for its alcohol-centric business only) found themselves repelled by Constellation’s entry into the cannabis market.

This might explain why Constellation’s PE has contracted to 13 while competitors like Boston Beer Co (NYSE:SAM) and Brown Forman Corp (NYSE:BF.B) have expanded their PE ratios to 40 and 37 respectively despite secular growth in beer slowing.

In other words, investment capital flowed out of Constellation and into competitors with no cannabis exposure. AB InBev (NYSE:BUD), who has also made plays in the cannabis space has seen its stock decline and its PE contract to 24, but because they did not invest billions into a cannabis company like Constellation did, their price multiple has not been punished to the same extent as Constellation’s and has recently recovered to 39X.

If Constellation’s multiple were to revert to the industry mean average of 20, that would put its stock back in the $260 range.

But cannabis is a disruptor to alcohol; how does that affect Constellation?

Two U.S. universities found that states with legalized medical marijuana saw nearly 15% reductions in monthly alcohol sales. In response, some alcohol companies–in fear of losing market share–went on the defensive by bankrolling efforts to stifle cannabis’ progress.

Constellation took the offensive approach instead by making a huge multi-billion investment in Canopy Growth Corp in an attempt to position itself on—what perhaps may prove to be—the right side of history. Rather than stifling innovation, Constellation chose to fuel it and be a part of it. The ability of Constellation’s management to see the big picture and attempt to evolve should be lauded by investors.

But a risk-averse investor might ask, “Why even bother investing in Constellation? If there is data showing that the legalization of medical marijuana reduces alcohol sales by 15% in the legalized regions, wouldn’t any potential gains in cannabis be offset by a disrupted alcohol business?”

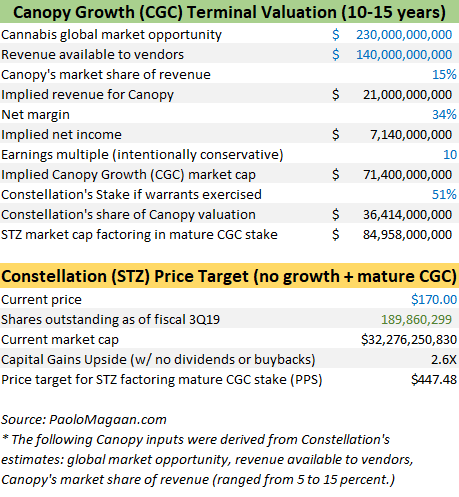

The short answer is no, because the market opportunity for cannabis is large enough to compensate for any cannibalization of Constellation’s alcohol business many times over, even if Canopy does not dominate the market. Even after factoring 15% declines across Constellation’s entire alcohol business and no further growth in perpetuity (which is unrealistic considering Constellation is still growing, albeit slower than the past decade), the potential gains from Constellation’s majority stake in Canopy would offset the losses and still provide 2.4X upside for shareholders at the price of $170. Over a 10-year period, that’s a little over 14% annualized, not even accounting for Constellation’s dividend and share buybacks.

As for the long term base case, here is a consolidated table of my valuation:

Constellation is returning $4.5 billion to shareholders in the form of buybacks and dividends over the next 3 years.

Constellation plans to return $4.5 billion to shareholders in the form of dividends and share buybacks over the next 3 years out to 2021. With Constellation’s market cap at approximately $32 billion, that implies a yield of approximately 14 to 28 percent on share buybacks and dividends alone.

Constellation’s “Call Option” on Canopy

Constellation possesses warrants on Canopy that, if exercised, will give them a controlling stake in the company. These warrants offer flexibility to Constellation and its shareholders until August 2021 when the warrants expire.

If the cannabis story continues to unfold favorably (e.g. U.S. legalization on the federal level), then Constellation can exercise its warrants and cement a controlling stake in the world’s largest cannabis company.

But if for some reason there is a cause for concern about the cannabis story (such as a stall in U.S. federal-level legalization), then Constellation can just let the warrants expire.

Constellation has also expressed that if they decide not to exercise the Canopy warrants, then they intend to take the money they would have used to exercise the Canopy warrants and return it to shareholders. That amount is another $4.5 billion.

Conclusion

Why buy CGC at the current market price if STZ has already acquired it at a lower cost basis? I wouldn’t.

Why hold on to CGC for 10 to 15 years without being paid a dividend if STZ is already paying a dividend and planning to buyback shares while owning a potentially-controlling stake in the company? I wouldn’t.

Why pair trade two cannabis stocks to hedge or implement risky option plays when STZ already has warrants? I wouldn’t. The issue with pair trading (e.g. long CGC and short another cannabis stock) is that cannabis stocks have the potential to become bubble prone, especially as the story unfolds and more people become aware of its legitimacy. In the event that the shorted cannabis stock makes a parabolic move to the upside while CGC does not participate, your portfolio could take irreparable damage from your pair trade, even if the moves are unwarranted. No thanks.

Purchasing shares of STZ comes with a better opportunity cost than buying CGC shares outright. In the short term, you have an undervalued STZ that has been unfairly punished by the market relative to its peers. Over the next 3 years, you’ll receive your share of $4.5 billion in dividends and buybacks. And in the long term (10 to 15 years), you possess a lottery ticket on the cannabis growth story via Canopy Growth Corp. Despite currently being the largest cannabis company by market cap, they don’t need to dominate the market in the future for you to do very well. Moreover, you can sit back passively and allow Constellation’s management (who has played their hand beautifully so far) to decide how much exposure to cannabis makes sense as the future unfolds.

In other words: Heads you win. Tails you win.

Disclosure: I am long STZ. This article expresses my opinions only, and is not to be misconstrued as investment advice or a recommendation to buy or sell stock. For more information, refer to the Terms of Use.

Update 11/22/19: I sold my entire STZ position today. I believe there are better investments out there for me, and the cannabis industry has so far been underwhelming in terms of performance. I pocketed 3 quarterly dividends and sold for a minor profit.