Investment Thesis: Potential Four-Bagger By 2021

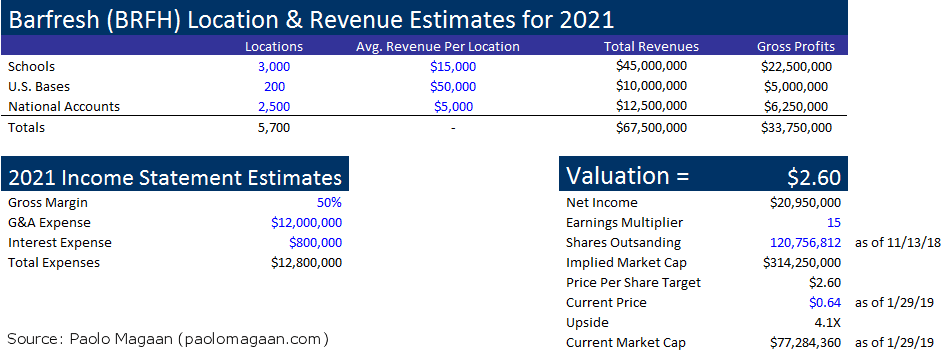

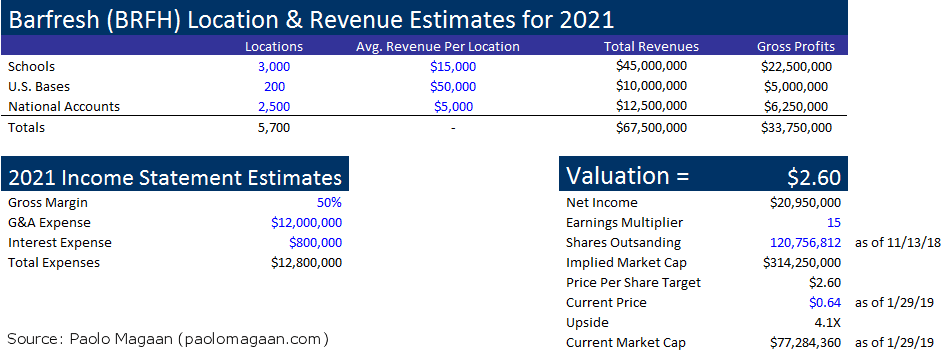

Based on my conservative estimates, $77 million frozen-beverage producer, Barfresh Food Group (BRFH:OTCQB), can grow into a $300 million valuation by 2021, implying over 400% upside. On a per-share basis, this implies that BRFH’s $0.64 stock can organically grow to $2.60.

Business Overview

Barfresh Food Group produces ready-to-blend frozen beverages through contract manufacturers in Utah and Arkansas, and is headquartered in Beverly Hills, California.

Finished products are sold to distributors (notably, Sysco), schools, U.S. military bases, food service providers, and quick service restaurants (via PepsiCo, who offers Barfresh’s products to their national accounts.)

Barfresh’s business prospects have attracted investment from €1.5 billion French holding company, Unibel (owner of the Laughing Cow dairy brand). Unibel is Barfresh’s largest shareholder with a ~19% stake, and has a seat on the board.

Narrative

Early purchasers of BRFH stock became antsy over the years as results were slow to materialize. But 2018 was a breakout year for Barfresh, fundamentally. After years of being a development company since 2012, they finally began to show promise in the execution of their business plan. Notable accomplishments for 2018 include:

- Receiving approval to market products to all five branches of the U.S. Armed Forces. There are 940 military bases, according to management, and Barfresh has agreements with 75 bases to sell product, compared to 0 in the beginning of 2018. [Update: As of January 29, 2019, Barfresh products are approved for roll out in 100 bases, and management expects all locations to be installed and pouring within the next 60 days.]

- Out of 98,000 U.S. schools, Barfresh’s products are currently in over 300 schools, compared to only 30 in the beginning of 2018. CEO Delle Coste stated on the 2Q18 earnings call that he expects Barfresh to be in “several thousand” schools in a “few years.”

- Revenues increased 138% in 3Q18 compared to the same quarter of the previous year.

- To end 2018 on a high note, Barfresh landed a 2,500-location national account in December 2018, which hasn’t yet been reflected in financial results. This is a significant catalyst moving forward. The national account has not yet been named, although the company has called it a “leading national restaurant chain”.

Competitive Advantages

Anyone can make a smoothie, so what makes Barfresh special?

After reflecting on competitors and the industry landscape, I identified the following business strengths for Barfresh:

(1) Compelling, patented product for any food service provider

Traditional smoothies take long to make, have consistency issues depending on the skill of the preparer, and have a higher risk of contamination when dealing with fresh ingredients. Barfresh, on the other hand, packs the smoothie mix, fruit, and ice into a single package which makes smoothies quick to prepare. This video shows Barfresh’s CEO demonstrating how the process works. Rather than slicing and dicing fruit and creating all sorts of mess and waste, the single package is emptied into a blender with some water and served within a minute. This delivery system is patented in 16 countries including the U.S. and Canada for the next two decades. So while anyone can make a smoothie, only Barfresh possesses the patent for this convenient delivery system, and it has proven to be a strong selling point to all sorts of food service providers because it reduces costs and speeds up training and service time. The customer base is versatile and includes pizza shops, sandwich shops, donut shops, schools, military bases, national parks, bowling alleys, hospitals, and bars.

(2) First mover advantage in a niche market

The market opportunity for schools and military bases is niche enough that larger competitors are not compelled to enter the market. At the same time, it’s a big enough opportunity to move the needle for a micro cap company like Barfresh to the tune of 4X upside by 2021. Receiving product approval from schools and the U.S. military is a lengthy process, and it took about a year for Barfresh to get approved to even start selling to potential customers. This is a barrier of entry in itself to any would-be poachers. But even if another competitor was willing to wait many months, there is another layer of protection for Barfresh: the inefficiency of double-selling. Essentially, competitors would have to double-sell the military, for example, something Barfresh is already providing. This is why larger companies would probably rather acquire Barfresh when it matures, or work with them, rather than investing resources to figure out how to circumvent the patent and/or spend a year trying to enter an already-claimed niche market, as evidenced by the next point. With CEO Delle Coste being the inventor of the method and still relatively young, there is also an element of personal passion and pride that is hard to replicate for a larger company; and while things like passion and pride are hard to quantify in terms of its benefits, they should not be discounted.

(3) Strong allies

Barfresh is backed by Unibel, PepsiCo, and Sysco. That’s a lot of muscle behind a small $77 million company. Unibel (UNBL:Paris), a €1.5 billion French food company (you might recognize their dairy brand, Laughing Cow), is Barfresh’s largest shareholder with nearly a 19% stake. PepsiCo is Barfresh’s exclusive sales representative in the food service channel in the U.S. and Canada, which means PepsiCo (PEP:NASDAQ) includes Barfresh’s products in their offerings to large, national accounts. Sysco (SYY:NYSE), the largest broadline distributor in the U.S., distributes Barfresh’s products on an exclusive basis.

Barfresh’s management has also been willing to extend capital to the business, providing working capital as necessary through convertible notes.

Risk Factors

Considering everything Barfresh has going for it, executing the growth plan should be relatively straightforward. However, there are a couple of risk factors out of many that I am specifically tracking closely.

(1) Not yet profitable

Bafresh is not yet profitable and currently burns about $1.2 million each quarter. Although they received another $1.6 million of funding in December 2018, that $1.6 million probably won’t last half a year unless the 2,500-location that was just secured in December 2018 (not yet reflected in financial results) can offset the current cash burn. Today’s buyers of BRFH stock are essentially wagering that the upcoming revenues from the 2,500-location national account, along with the ever-growing number of schools and military bases serving Barfresh’s products, will rise enough to neutralize the $1.2 million cash burn and get the business past breakeven and into self-sustaining territory before their capital reserves run out.

If this does not occur, then Barfresh will need to raise more capital, which would dilute the current shareholders. I don’t doubt that Barfresh can raise more capital at fair terms considering that Unibel is backing them (they are the source of the $1.6 million), and management, as well as other significant investors, have been willing to capitalize the business when needed.

(2) Weakness in internal control over financial reporting

Another risk factor is that the company lacks proper financial controls. Company filings state that management found a material weakness in the company’s internal control over financial reporting, citing inadequate segregation of duties: “We have an inadequate number of personnel to properly implement certain control procedures related to segregation of duties.”

This is an issue that many small companies in particular have, but it is an issue that I expect should be resolved as the business grows bigger and more resources are available to the company. I suspect that Barfresh is a prime candidate for being acquired by a larger company later on down the line if the business model does succeed, and if that occurs, this issue would undoubtedly be fixed by its acquirer.

Valuation & Notes

To account for the above risk factors, and also to build a margin of safety in my estimates of Barfresh’s future prospects, my valuation completely discounts further growth in national accounts, and focuses only on the military and school opportunity. Even with this limitation, I still calculated significant upside in BRFH shares if the underlying company can execute their business plan.

I arrived at a valuation of $314 million, or $2.60 per share, or 4X current levels by 2021.

Barfresh encourages their customers to commit to multi-year contracts with annual volume commitments, so management was able to provide reasonably reliable guidance on the economics of their business.

Schools: According to the company, each school can be expected to bring in $10,000 to $20,000 in annual revenue. There are 98,000 U.S. schools and Barfresh is currently in over 300 schools. Management stated on the 2Q18 earnings call that it’s possible for the company to be in “several thousand [schools] in a few years”, and that they “could actually be [in several thousand schools] a lot sooner than that.” Although the wording is a bit ambiguous, the definition of “several” is “more than two, but not many.” So for my model, I assumed 3,000 schools as a reasonable estimate by 2021.

U.S. Bases: According to the company, each military base can be expected to bring in $50,000 to $80,000 in annual revenue. There are 940 bases and Barfresh is currently in 100. By 2021, I estimate that Barfresh can be in at least 200 bases, which is a conservative estimate considering that in less than a year, Barfresh expanded into 100 bases.

QSRs, National Accounts: Because the name of the 2,500-location national account has not yet been revealed by management, and also to mitigate the risk factors outlined in the previous section by building a margin of safety, my estimates completely discount further growth in national accounts and intentionally low-balls revenue per location.

Gross Margins: Gross margins for 2Q18 were 52% and 55% to 3Q18. For the purpose of conservativeness, I rounded gross margins down to 50% for my model. Realistically however, gross margins should remain stable, as frozen beverages are the highest-margin beverage products after alcohol, Barfresh’s single-serve is patented (which gives less bargaining power to food service providers, since they cannot turn to anyone else for the same method), and Barfresh may benefit from economies of scale on the production side as the business grows.

G&A Expense: The company’s G&A expenses will increase as the business grows, and they also need to spend more money to address the internal control issue I mentioned earlier in the risk factors section. Therefore, I rounded up to $3 million for general and administrative expenses per quarter from 3Q18’s $2.1 million, which equates to an annual run rate of $12 million in G&A expenses for my model.

Interest Expense: Rounded up to $200K quarterly from 3Q18’s $196K, which equates to an annual run rate of $800,000 in interest expenses. If everything goes smoothly, Barfresh shouldn’t need to take out any more debt. If there are hiccups in execution, then this item will need to be updated as necessary.

Earnings Multiplier: 15X is a low multiple considering that after 2021, Barfresh would still have plenty of potential growth ahead of it: 98,000 schools, 940 bases, and the wild card of whichever QSRs they can land. In 2021, Barfresh would still be far from a mature company, and I anticipate that their revenue growth rate will be far greater than 15% annually, which is why 15X is a very conservative multiple. Moreover, with the business achieving profitability according to the model, the key risk factors of today would effectively be off the table. The reason I chose 15X is to be conservative about my expectations to refrain from becoming too overoptimistic. Yet, the value of BRFH’s future prospects still pops out.

Shares Outstanding: For every one million shares of dilution, the upside decreases by $0.02. I used the latest number available, but this input will need to be updated regularly.

Conclusion

By the end of 2021, I conservatively estimate that Barfresh will be generating an annual earnings run rate of ~$21 million on the back of $67.5 million revenues, selling products to 3,000 schools out of 98,000, and 200 military bases out of 940. I see at least 400% upside between now and 2021 on only a mere 15X earnings multiple. This valuation would propel BRFH from a micro cap to a small cap stock, which would increase the stock’s visibility as it appears on more investors’ radars, which could potentially drive multiple expansion. Even after 2021, Barfresh would still be far from a mature company, so while this article only considers what could conservatively happen in the next 3 years, the growth story has much more track to run beyond 2021.

Disclosure: I am long BRFH. This article expresses my opinions only, and is not to be misconstrued as investment advice or a recommendation to buy or sell stock. For more information, refer to the Terms of Use.

HI, I’m a long time shareholder of BRFH and my DD has agreed with yours. Just wanted to drop a line saying if you love BRFH, you really should take a look at LXXGF. Very much the same scenario: R&D is done and about to fully commercialize within months. Beta tests completed successfully. No more financing needed. Lots of video and written info available (more than BRFH) from the company and elsewhere (Ihub). Razor/razor blade business model with HUGE margins. Very transparent. CEO worked for the gov’t when their machine was invented by him and now he has improved it to something no one else has and the need is tremendous. Multiple huge markets are ready to buy. Anyway, enough ‘pumping’; you probably get hundreds of this type of replies and ignore them. I’m going to make a lot of money thanks to LXXGF and BRFH. BTW, I agree with your assessment of FB and IG and extend that to twitter. Never been on instagram, never twittered, and use FB sparingly for hometown historical stuff. Have a great 2020! Mark

Hi Mark,

Thanks for the comment, as well as the tip on LXXGF. I’ve come across that stock before but only gave it a quick glance before deeming it outside my circle of competence. However, your words here have motivated me to give it a second look soon, as “imminent explosive expansion” and “verge of profitability” micro cap scenarios interest me greatly.

Glad to know you read my post about Facebook and Instagram, too. Life certainly is a lot simpler, enjoyable, and more productive without the distraction of social media.

Have a prosperous and healthy 2020!

I appreciate your response. Just a couple more things which you will no doubt discover as you explore LXXGF. Their LX2 Genetic Analyzer can do in a couple hours, what now takes 2 to 4 days to complete – with animal and human lives potentially at stake. That is just two of the markets in which this can be used. I look forward to reading your analysis of LXXGF! Website: www.lexagene.com